Donate Today For a Better Tomorrow.

Your donation provides tutors for struggling students, resources for vulnerable Veterans, companions for isolated seniors, and food security for hungry families, creating a better tomorrow for everyone!

Make Your Donation Recurring.

Join the club of “Regulars!” You know who we’re talking about! The people you can count on to show up on a regular basis and provide support. We depend on our “regular donors” as much as we depend on our “regular volunteers.” Commit to a “regular” donation so we can create “regular” impact.

$50

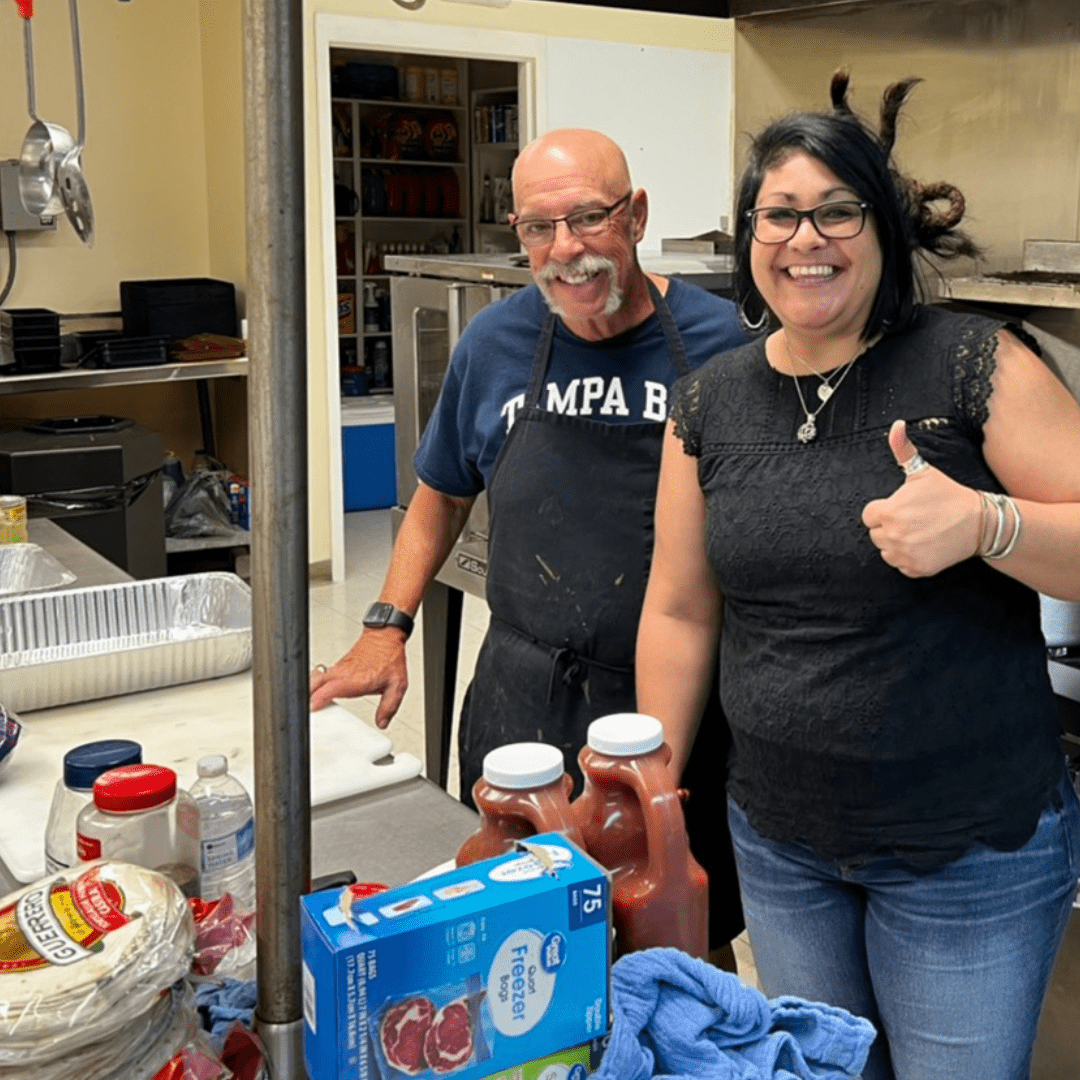

Provides 25 meals prepared by

volunteers for hungry families

$100

Provides home essentials for 1 Veteran transitioning from homelessness to housing

$150

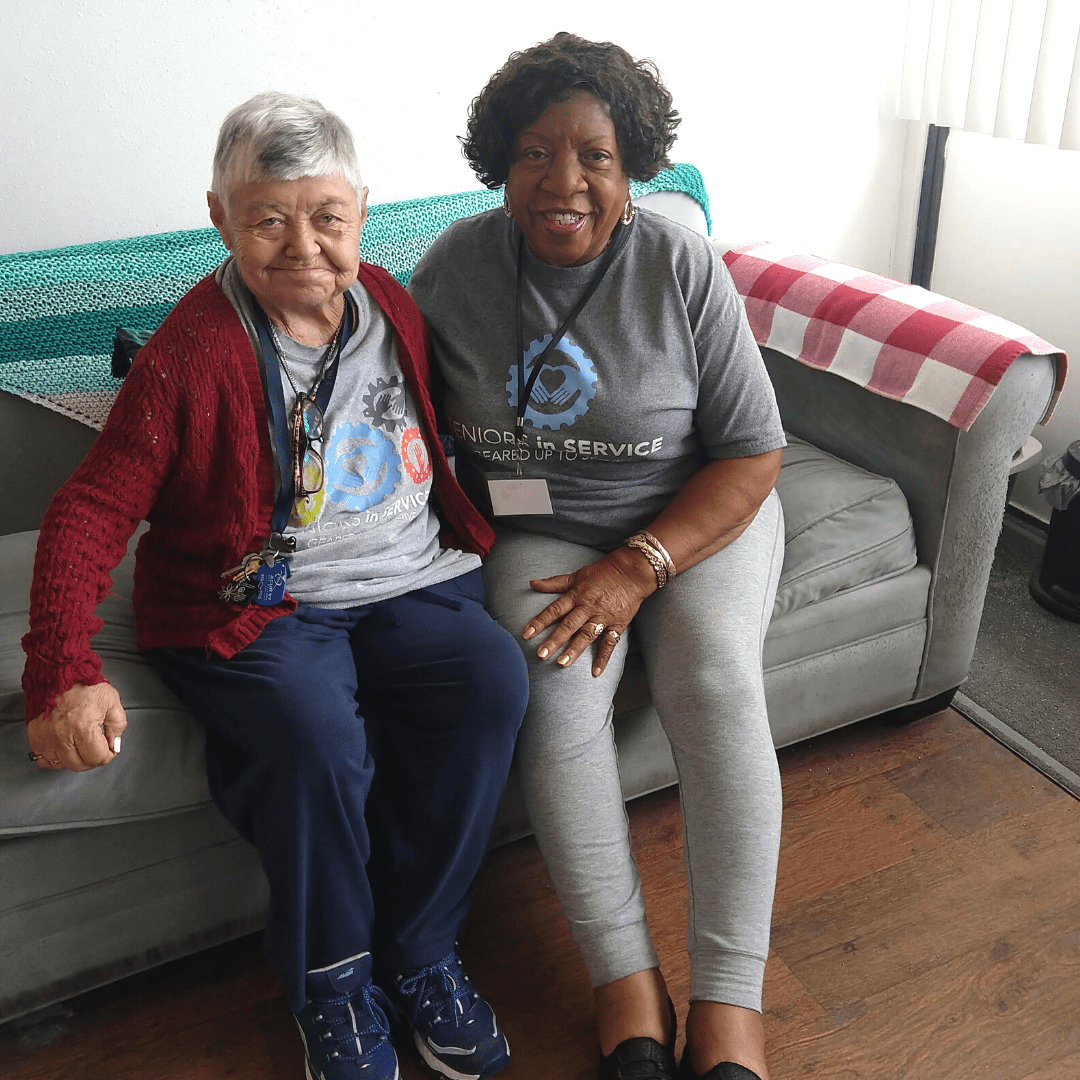

Provides companionship for 1 isolated senior for an entire month

$250

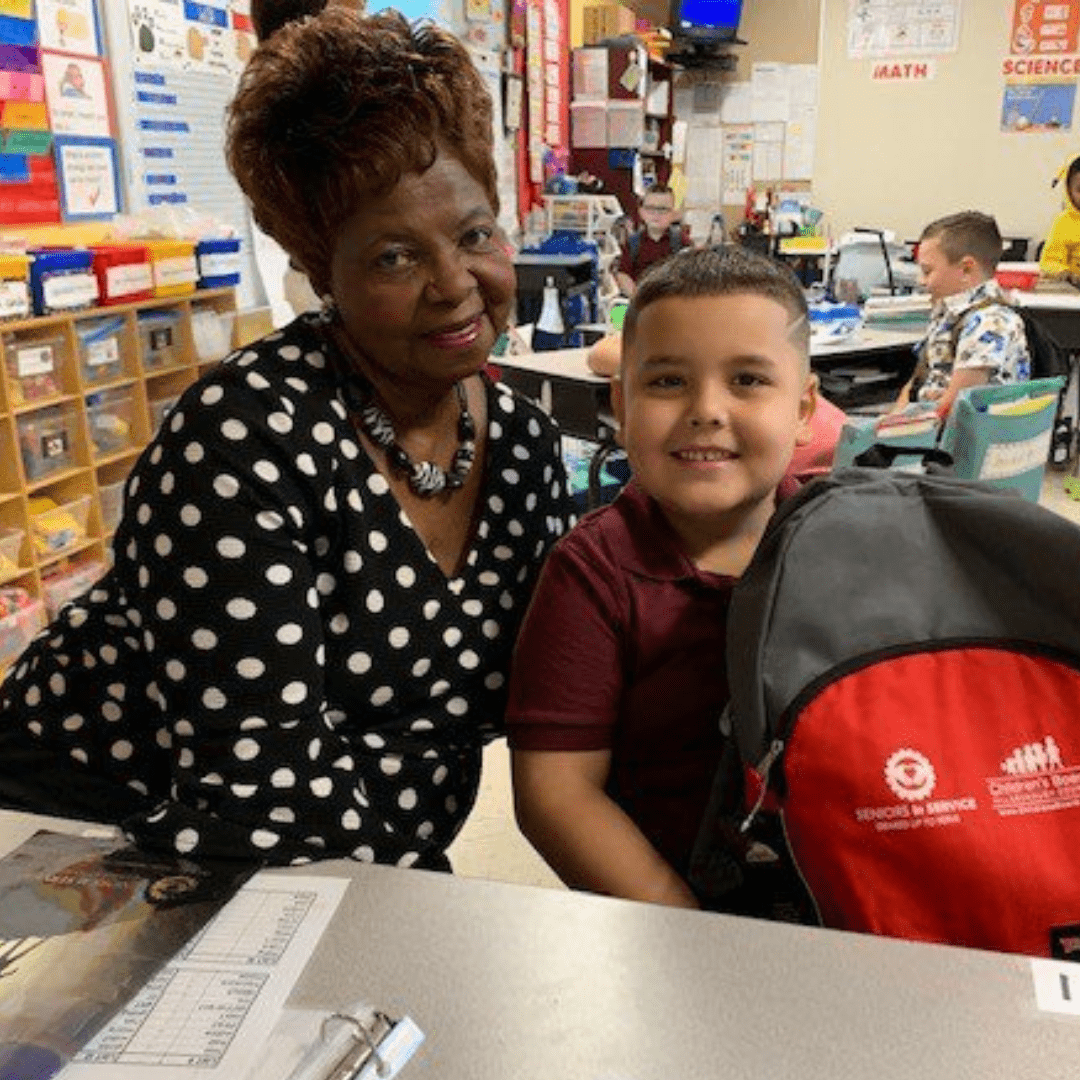

Provides 50 hours of one-on-one tutoring for struggling students

More Ways to Give

A legacy commitment is an investment in sustainable work that will directly impact Tampa Bay’s most vulnerable communities and transform the future for generations to come. For more information to make a planned gift to Seniors in Service, contact Robin Ingles at ringles@seniorsinservice.org.

Leave a legacy.

Give a gift in your will.

Whether you designate a specific amount or leave a percentage of your estate, your legacy gift will provide essential services for future generations.

Sample Will Language

I [name], of [city, state ZIP], bequeath the sum of $[ ] or [ ] percent of my estate to Seniors in Service, a nonprofit organization with a business address of 1306 W. Sligh Ave., Tampa, FL 33604 and a tax identification number 59-2422975 for its unrestricted use and purpose.

Beneficiary designations

Your retirement plans, life insurance policies, and annuities can all help bring resources to communities in need.

Non-cash assets

Donating certain non-cash assets like real estate can provide significant tax benefits while advancing our mission.

Qualified charitable distributions

If you are aged 72 or older, you can give up to $100,000 per year from your IRA, allowing you to exclude the amount of your RMD from your income, even if you don’t itemize your taxes each year.